The truth behind the Fort Knox conspiracy, which claimed its gold had been sold off and forced the US Mint to prove that the vault wasn’t empty.

Money is an odd thing. It’s so central to all our lives, yet most people have no clue that it functions solely on the basis of trust. In 1974, the trust in the US Dollar was severely tested thanks to a bizarre conspiracy theory claiming that Fort Knox, the impregnable fortress storing much of America’s gold, was actually empty. In a post-Watergate atmosphere of mistrust, the Fort Knox conspiracy forced the US Mint, for only the second time in its history, to open its vault.

The fascinating circumstances about how the Fort Knox gold rumour took root strike at the nature of truth and the frailty of trust-based money.

Fifty years on, in our post-truth world, the story resonates with the struggles of a new kind of money to gain adoption, designed to function without the trust that, just as in 1974, is in such short supply.

The history & function of Fort Knox

Fort Knox is an army post in Kentucky, but its name has become synonymous with protecting a large proportion of the gold held by the US Treasury. The United States Bullion Depository actually holds the reserves in an adjacent facility.

Prior to the 1930s, America’s gold reserves were held in Philadelphia and New York, but in the post-World War 1 era, the heightened fear of invasion motivated a decision to create a purpose-built facility inland.

If this sounds like an overreaction, remember that the Bank of England created its own army in 1798, the Corps of Bank Volunteers, a 450-strong force solely dedicated to protecting the Bank of England’s vaults from a French attack.

There was another reason for building a new vault for America’s gold in the 30s. The government suddenly had a lot more of the shiny yellow stuff.

In 1933, President Franklin D Roosevelt issued Executive Order 6102 banning the hoarding of gold and issuing a compulsory purchase at a fixed price of $20.67.

Roosevelt essentially confiscated private gold and revalued it at $35 a troy ounce, boosting public finances with an immediate 69% profit. That gold was melted down, swelling the nation’s reserves and adding urgency to the need for a safer vault to house it.

The Bullion Depository facility took 18 months to build, requiring 16,000 cubic feet of granite, 4,200 cubic yards of concrete, 750 tons of reinforcing steel, and 670 tons of structural steel.

The first gold shipments started arriving in 1971, followed by a second tranche in 1941.

The Fort Knox paradox

Fort Knox developed a reputation as the most secure building on earth. Aside from employing a dedicated police force, The USMP (The United States Mint Police) and state-of-the-art security, no one was allowed into the vault.

“The Depository is a classified facility. No visitors are permitted, and no exceptions are made.”

Fort Knox security made no exceptions

Aside from gold deposits, there were no audits or inspections, except in 1953, just after President Eisenhower took office, after concerns about how much gold had been repatriated to World War II allies.

From Aug. 15, 1971, there was even more reason why the Fort Knox vault would be kept closed.

The Nixon Shock ended the policy of allowing foreign governments to exchange U.S. Federal Reserve Notes for physical gold at the rate of $35 a troy ounce. This removed the main requirement for the physical removal of gold from Fort Knox.

This combination of extreme security, secrecy and infrequent use presented a paradox – if something is so valuable that no one is allowed to see it, how do you prove it exists? Broader political and social circumstances fuelled this paranoia.

The Watergate Scandal, which broke in 1972, had already destroyed faith in politicians and civil authority, so when you throw a severe financial crisis into the mix (as prevailed from 1972-74) the ground was fertile to ferment a story that questioned the nation’s greatest symbol of security.

The origins of the Fort Knox conspiracy

This unique atmosphere of distrust was exploited by Professor David Beter, an international financial legal consultant who described himself as a ‘patriot’.

His career featured credible stints as the legal counsel for the American Gold Association and the US Export-Import Bank.

After failing in a bid for the Governorship of West Virginia in 1968, Beter dedicated much of his time to supporting the presidential candidacy of Republican Governor George Wallace and throwing mud at the Rockefellers – the most powerful US family dynasty.

This mostly consisted of wild conspiracy theories shared through regular slots on night-time radio talk shows such as the Libby Lobby and the tabloid press. Beter was even credited with inspiring the Hunt Brothers’ insane gamble to plough their immense oil fortune into silver.

On July 7th, 1974, Beter gave an explosive interview to The National Tattler, which pushed all the right buttons with the fidgety public.

Powerful Americans have secretly permitted $20 billion worth of gold to be removed from Ft. Knox.

The National Tattler

Here’s a summary of how Beter justified his claims that the gold in Fort Knox had disappeared:

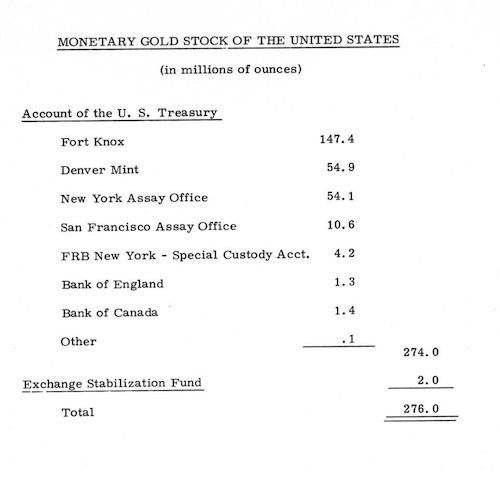

- Public Law 93-110, passed September 21st 1973, allowed the sale of gold at $42.22 per ounce to David Rockefeller.

- Secretary Schultz added weight to the conspiracy when he confirmed that any gold sales would be kept secret (for National Security reasons)

- The gold was then moved to the Netherlands as it was alleged that the Rockefellers controlled the Dutch monarchy.

- The gold would be sold back to the US government at $2,000 an ounce.

Back in 1973, Beter had written a book ‘The conspiracy against the dollar: The spirit of new imperialism” – an attack on the globalist aims of his bête noir, the Rockefellers, who he described as one part of a trinity, alongside the Kremlin and the Bolshevik-Zionist axis, out to control the world.

Conspiracy theories, the deep state. If this is all starting to sound very familiar, wait until you hear that Beter also claimed that David Rockefeller could fix all future elections by controlling a company that made electronic voting machines.

That was one of his more believable rumours; Beter promoted the idea that Mao Tse Dung had been dead six years before his official demise.

How the Fort Knox conspiracy grew

The publication of Beter’s claims in the National Taller started a chain reaction of events that, within months, led all the way to the vaults of Fort Knox itself.

Right-leaning members of Congress soon began to receive inquiries from worried constituents whipped up by the lurid claims. This forced a Congressional Committee to investigate the issue.

Rather than adding clarity and killing the issue stone dead, the enquiry opened an even bigger can of worms – questioning the function of the Federal Reserve and raising the thorny issue of who owned the nation’s gold reserves.

The Federal Reserve operates as an unofficial fourth branch of government, but its opaque quasi-public-private function and myriad committees added extra fuel to the fire as no one could categorically prove how much gold was in Fort Knox and who was responsible for it.

When the Chairman of the Board of Governors of the Federal Reserve System responded to a written request by Congressman John Rarick, it exposed a confusing state of affairs regarding responsibility for auditing the nation’s gold.

An inconsistent reporting system was interpreted to suggest that $11,460,000,000 of gold assets recorded on March 27th, 1974, had, by June, disappeared.

The Director of Mint Security, Mary Brooks, made matters worse “Those vaults are never opened; they are sealed”, in reference to the tape over the vault doors acting as proof the doors were opened.

Brooks claimed that the last audit was in July 1973, but the auditors didn’t actually enter the vault; they just checked the seals were unbroken, which didn’t help settle the issue.

Brooks also claimed the last time she knew that vault was opened was in 1968. Unfortunately, this was contradicted by General Victor H Harkin, in charge of Fort Knox, who claimed it was 1971.

Not only that, but an unnamed Guard said he hadn’t seen the gold for ten months [but then again, if the vaults were kept closed, why would he?]

The snowball began to grow with the Rockefellers’ director of information services, Henry Romney, neatly summing up the problem that the Fort Knox paradox presented in the face of Beter’s conspiracy claims.

The charges are ludicrous, but I haven’t personally seen the gold in Fort Knox.

Henry Romney, Director of information services for the Rockefellers

It became clear that nothing but a direct inspection by Congressmen and the media, accompanied by a thorough audit, could quell the growing hysteria around the gold in Fort Knox.

This decision was confirmed in a carefully worded press release issued by the US Department of Treasury on September 20th, 1974.

The tone was clearly designed to defuse the clouds of suspicion, create a distinction between the openness of the Ford administration and that of his disgraced predecessor, and underline that the public owned the gold.

By also inviting the press to witness the congressional inspection, the Mint is clearing away the cobwebs and re-assuring the public that their gold is intact.

Mary Brooks, The Director of Mint Security

So on Sept. 23, 1974, for only the second time in its history, the Bullion Depository at Fort Knox, Kentucky, opened its vault to 120 selected members of the press, a dozen members of Congress and representatives of the Mint and Treasury Department.

Was the Fort Knox vault empty?

With a buzz of helicopters and an air of expectation, a fleet of buses pulled into Gold Vault Road on an extraordinary mission – restore faith that Fort Knox actually held the gold it claimed.

I wonder if those politicians among the passengers seriously considered what would happen if the rumours, like Watergate, turned out to be true.

Aside from the price of gold going on an upward tear, confidence in the US Dollar as the global reserve currency would be destroyed along with the credibility of the US government itself.

But the US government was not going to knowingly set itself up for what would have been unrivalled public humiliation. The junket was heavily stage-managed, not least because there was a 104-hour time lock on the vault.

Nevertheless, the hands of Mary Brooks were likely sweating as she prepared to cut the tape on the vault, breaking the seal and allowing congressmen and reporters – who drew lots to decide who went in first – into the cramped chamber.

I’m very happy to show the country that the gold is here. I knew it was here, of course.

Mary Brooks, The Director of Mint Security

And, of course, it was there. The special visitors were dazzled by neatly stacked bars of glittering gold captured by the cameras of the attendant journalists.

- Read how a Sewer Hunter accessed the Bank of England vaults in a barely believable story.

Anticipating that photos alone wouldn’t silence the questions, the associated audit included technicians from the Bureau of the Mint with expertise in determining the quality and weight of gold.

Beter had peddled the idea that a secret tunnel could be used to squirrel the gold away, which was confirmed by one of the Mint officials.

“All vaults have this type of escape device.” explained an official. The tunnel was just in case someone got trapped in the vault; it also had a seal and could only be opened from the inside.

But the photos and the Proof of Reserves were never going to be enough.

The trust in Fort Knox and the US financial system had been openly questioned, giving the public a glimpse behind the Wizard’s curtain obscuring fiat money’s facade.

There was a third official visit to Fort Knox in 2017, including the Secretary of the Treasury Steven Mnuchin, the photos from which were only released after a Freedom of Information request.

But no amount of visits and assurances can solve the issue of trust. That’s the thing with conspiracy theories: once the genie is out of the bottle, it’s very hard to put it back in, and social media has taken the dilemma to a whole new level. Welcome to the post-truth era.

It would take a technical revolution to provide a novel solution to the problem created by trust-based money.

From Fort Knox to trustless money

In 2008, the blueprint for a new form of trustless money called Bitcoin was shared under a mysterious pseudonym, Satoshi Nakamoto.

Through a combination of digital technology, cryptography and game theory, Nakamoto – whoever they were – found a way to store the equivalent value of Fort Knox as a 256-bit number – a Private Key.

That Private Key can be carried around on a piece of paper, in a digital wallet on your phone/USB stick or if you trust your memory, just in your head, as a collection of twelve unique words, known as a Seed.

And the beauty of the cryptography behind Bitcoin is that it is nearly impossible for someone to guess that Private Key or Seed Phrase, making it an immeasurably more secure option than Fort Knox.

Yet anyone can verify the amount of Bitcoin a given address holds in seconds, solving the security/secrecy paradox.

No need for a special Congressional Committee or a crazy cross-country fact-finding mission. Just an internet connection and a block explorer.

This is why Bitcoin’s mantra is don’t trust, verify.

Unfortunately, humans are creatures of habit, so the rigours of looking after that Private Key (known as self-custody) have proved too much for many people who are attracted to crypto but prefer to opt-out of taking responsibility for it and fall back on trust.

Given the crypto space is unregulated and deposits are uninsured, this is an open invitation for bad actors.

Trustless money vs human nature

2022 proved again why it could be an expensive mistake to leave Private Keys in the hands of centralised services, like exchanges or so-called crypto banks. From a transparency perspective, these centralised services are black boxes functioning on trust, just like Fort Knox.

When market sentiment declined, sending the markets crashing, many of these services collapsed like dominos and were sadly exposed for exploiting that trust – embezzlement, poor risk management, incompetence and worse.

Now, in a febrile atmosphere of distrust similar to that which existed back in 1974, panic has set in, and trust has ironically evaporated from an industry predicated on a technology that is trustless.

Wild conspiracies easily take root; all crypto exchanges are assumed to be vulnerable, and attempts to verify their solvency with Proof of Reserve audits have backfired just like the inspection of Fort Knox did little to repair trust in authority.

Trust arrives on a snail and leaves on a horse, or maybe where crypto is considered, on a unicorn.

The world may have been introduced to trustless money, but we don’t appear ready to embrace it, leaving us vulnerable to another Fort Knox conspiracy.

The next time someone shouts that the vault we trust to keep all our money safe is empty, we’ll still have no meaningful way to verify it’s actually there.

FAQs

The Fort Knox Conspiracy suggested that Fort Knox’s vaults were empty because the gold had been sold and shipped to Holland.

Peter Beter started the Fort Knox Conspiracy through an interview with a US tabloid newspaper called the National Tatler.

Fort Knox was inspected by President Eisenhower in 1953, in 1974 in response to the Fort Knox Conspiracy and in 2017 when Steve Mnuchin and select members of Congress were admitted.

The inspection of Fort Knox in 1974 found a tunnel that was only accessible from the inside. This is a standard safety feature providing a means of escape should anyone be accidentally trapped inside.

Sources

Numismatic News (via Wayback Machine), September 15th, 2009

Washington Observer Newsletter, October 1st, 1974 (Archive)

Dayton Daily News, October 6th, 1974 (Archive)

The Alien Critic May 1974, Vol 3 Issue 2 (Archive)

No Free Lunch

There is no such thing as a free lunch, but if you’re hungry to find out why, we’re here to help.

You can learn the meaning and origin of the no free lunch concept, as well as the broader philosophy behind the idea that nothing can ever be regarded as free.

We look at our relationship with money and truth, examining all of the supposed shortcuts, life hacks and get-rich-quick schemes.