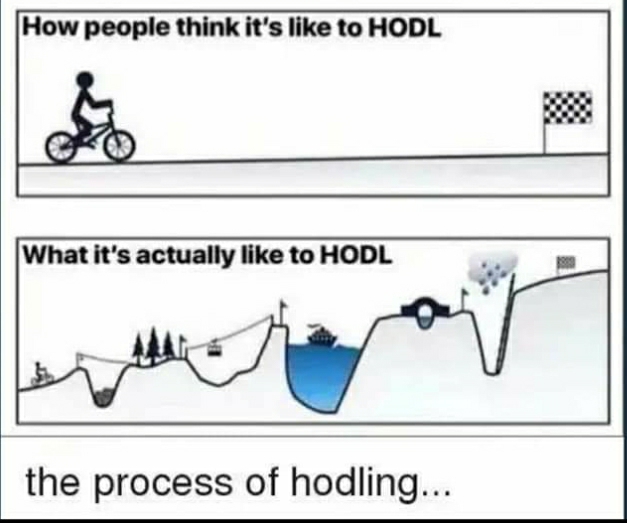

Hodling is a meme describing the commitment needed to hold Bitcoin and screen out volatility and FUD. The USPs of this new internet money present staunch believers with a unique challenge, aka the Bitcoin hodler’s dilemma.

Warren Buffett, arguably the world’s most famous investor, once said that his favourite period for holding a stock is ‘forever’. Bitcoin’s hardcore holders are on the same page as the Sage of Omaha. Investing long-term isn’t just the optimal investor strategy for Bitcoin’s unique value proposition; it’s an expression of ideological commitment, complete with its own meme, hodling.

But given Bitcoin doesn’t natively generate any dividend-like passive income, the hodling mentality presents an unusual challenge.

Like holding on to a rising balloon, the longer you own Bitcoin, the more attached you become and the less likely you are to sell or take risks in generating a return, creating a recursive logic that questions the purpose of committed Bitcoin ownership. Welcome to the hodler’s dilemma.

Is the Bitcoin hodler’s dilemma a First World Problem?

Given the uncertain economic times, the idea that owning an appreciating asset presents any dilemma sounds like a first-world problem with a very simple solution. Take the win by selling your precious Bitcoin to lock in an acceptable profit level and move on (maybe fix your spelling while you’re at it).

Plenty of traders take that dispassionate and pragmatic view of Bitcoin. They’re not interested in mantras or memes but rather in the opportunities for short-term profit that Bitcoin’s unprecedented volatility provides.

Others are less structured in their approach to trading (which is being charitable) driven purely by FOMO and the hope of getting rich quickly.

Then there are those around the world using Bitcoin as a means to an end; escaping crippling inflation, financial exclusion or repression.

Hodling is different. It’s an investment strategy predicated on revolution as much as fundamental analysis.

Bitcoin as a lifeboat

Launched in 2009, Bitcoin wasn’t a direct response to the financial crisis of the previous year, but the anti-establishment sentiment that defines hodling was forged from the collective PTSD and sense of hopelessness generated by those systemic failings.

To hodlers, Bitcoin is a lifeboat in an ever-worsening economic storm. Though a 17,000% increase in value since launch suggests it’s a safe haven, valuation is still largely perception-based, meaning that in terms of price, its 15-year journey has been a rollercoaster, not a gradual incline.

Surviving 80% drops with commitment intact generates some serious attachment issues, further reinforcing the hodling mentality in a feedback loop.

But what’s so interesting about hodling is that it cannot be written off as just blind faith because hodling is also about empowerment and education. DYOR (do your own research) is a core element of the mantra, so to understand the hodler’s dilemma, you have to start by understanding Bitcoin’s USP.

The term ‘hodling’ originates from a post on BitCoinTalk Forum, made by a user named GameKyuubi as a rallying cry for Bitcoin. It was mistakenly titled “I AM HODLING” but the term stuck.

I am hodling – Bitcointalk, December 18th, 2013

Bitcoin’s USP – Unforgeable digital scarcity

Bitcoin is a new form of digital money without any central control and the quality of unforgeable digital scarcity, which admittedly is a bit of a word salad.

In really simple terms, this means Bitcoin is virtual money, yet genuinely scarce. You cannot right-click and create more Bitcoin entries in a database.

Scarcity is one of the core characteristics of sound money – along with being portable, divisible, fungible, and durable – all boxes that Bitcoin ticks.

Its scarcity isn’t just unforgeable; it is predictable, with a set of rules determining how many Bitcoin will ever exist (just 21 million) and the rate at which the supply will grow to meet that fixed limit.

Those rules are enforced by a large distributed network of computers, a majority of which would have to agree to any changes. This is the power of decentralised money.

Now, by all means, go away and jump down the Bitcoin rabbit hole, but in order to keep this article to regulation length, we’ll leave the description of how Bitcoin works there.

What we’ve hopefully conveyed is that Bitcoin’s transparent function naturally lends itself to rational economic decision-making, which is a key component of the hodler mentality.

The logic is simple – if there is increasing demand for an asset that has a fixed supply and benefits from network effects, the price can only go up over the long run.

Those last two words are crucial because though Bitcoin has been working like clockwork since 2009, according to its protocol rules and proving its digital scarcity, price is a bet on broader adoption and overcoming complex political and behavioural obstacles.

Guessing how those influences will play out is the antithesis of Bitcoin’s predictability.

So, in the short-term, price is largely based on sentiment around issues like regulation, correlation to the wider economy and macro events like wars and pandemics. All this uncertainty translates into extreme short-term volatility.

Zoom out, and the trend slopes up to the right, but as only a tiny percentage of hodlers are OGs, the more recent converts may have only felt the chill of a so-called Bitcoin Winter or the euphoria of number only goes up.

Hodling is an optimal strategy for wherever you sit on that oscillating price curve.

Hodling – turning low time preference into a meme

Delaying gratification of something in the expectation of greater reward in the future is known as having a low-time preference. You can argue that human’s shift from hunter-gather to farmer resulted from a shift in time preference.

That change in mindset was accompanied by the use of collectables (like necklaces of teeth) as a store of value, a means of transporting energy through space and time. Those collectables were the precursors of a litany of different forms of money, of which Bitcoin is the most recent iteration.

So you can argue that holding Bitcoin as a store of value is entirely rational, resulting from low-time preference thinking and expectation of future value.

Hodling is how the Bitcoin community memes time preference. It turns investors into believers of shared ethos, where the why of Bitcoin becomes more important than the how. And the hodler’s rationale for Bitcoin’s existence is to replace the prevailing fiat monetary system – which is profoundly broken.

Since 1971, money has been backed simply by authority rather than gold. Central banks have the power to debase money as they see fit, and in the absence of an alternative, we have to trust their decisions despite the pernicious erosion of our savings that the inevitable inflation creates.

The Fort Knox Conspiracy illustrates what happens when we’re asked to trust without a simple means of verification.

Bitcoin presents a challenge to this prevailing financial system that essentially expects us to believe that governments can magically create money out of thin air without negative consequences, and if you check our URL you know we firmly believe there’s no such thing as a free lunch. This is the root of Bitcoin’s ideological argument.

Like any great meme, hodling translates that complex combination of concepts that Bitcoin represents – on a technical, economic and political level – into a very simple and shareable idea.

Hodling is, therefore, more a movement than an investing club where the strength of commitment it inspires provides the ultimate backstop against selling pressure from weaker hands dazzled by FOMO or seduced by leverage.

Hodler resolve helps Bitcoin’s price find a bottom where other assets might face total capitulation.

Though time preference and the value of digital scarcity are rooted in rational thinking, holding on to that rising balloon also creates an emotional attachment that is an expression of human irrationality. The endowment effect best describes this critical part of the hodler experience.

If you’re hanging on to a rising balloon, you’re presented with a difficult decision – let go before it’s too late or hang on and keep getting higher, posing the question: how long can you keep a grip on the rope?

Danny, Withnail and I

Bitcoin’s Endowment Effect

Behavioural psychologists describe the ‘Endowment Effect’ as attaching greater value to something you own through an aversion to losing that item. A famous experiment with a mug illustrates the point:

Participants were given a mug and then offered the chance to sell it or trade it for an equally valued alternative (pens). They found that the amount participants required as compensation for the mug once their ownership of the mug had been established (“willingness to accept”) was approximately twice as high as the amount they were willing to pay to acquire the mug (“willingness to pay”).

https://en.wikipedia.org/wiki/Endowment_effect

The hodling experience is self-reinforcing, building greater attachment over time and decreasing the propensity to sell. If you hold from an all-time high through a nerve-shredding 80% correction, simply returning to where you started doesn’t seem like much of a win, given your attachment.

The goalpost of acceptable profit moves further forward through each cycle.

Bitcoin’s excessive volatility and its anti-establishment ethos combine to create a bunker mentality that is fertile ground for the growth of the endowment effect.

This emotional attachment may also provide a barrier to simply spending Bitcoin on goods and services, which the Lightning Network is making increasingly possible and is, after all, a core function of money, as a medium of exchange.

A True HODLer Buys Goods and Services With Their Coin

Rule 5 of the Holder Manifesto – Github

But Warren Buffett’s forever mantra doesn’t require that hodlers sell or spend their precious Bitcoin, just that it generates an income, so surely passive income is the solution to the hodler’s dilemma?

Bitcoin’s passive income problem

Bitcoin is peer-to-peer cash, which means it can be transmitted from one user directly to another with no intermediary, like a bank, involved.

Users access their Bitcoin through various forms of digital wallet that act as an interface to the digital ledger of balances that the network of computers described above maintains.

To send or spend Bitcoin, a wallet signs a transaction with a unique piece of data – a Private Key – essentially a long string of text and numbers like a password that must be protected at all costs. However, as a decentralised money, Bitcoin provides no safety net in the case of loss or theft of that Private Key.

Once it’s gone, it’s gone, so retaining control of Private Keys is another core pillar of the hodler manifesto summarised in the mantra – not your keys, not your coins.

Alongside the absence of 24-hour chat support or password reset, there are no government-backed insurance schemes to underwrite services that will happily take custody of your Bitcoin and pay you a passive income in return, a sector known as CEFI.

Bitcoin’s First Fiction Anthology

Discover 21 short stories imagining how Bitcoin might impact all our futures. 5* on Amazon.

Centralised finance (CEFI) started to gain traction around 2017, applying traditional banking borrow/lend models to crypto assets in a centralised venue. Services promised to pay a passive income while lending out deposits to collateralised borrowers. Well, that was the promise but not the reality.

We know that you cannot generate value without taking risks (our URL should have given that away), and CEFI has proven that point in a spectacularly disastrous fashion.

The most recent Bitcoin market downturn (beginning around March 2022) triggered a cascading credit crisis, revealing reckless risk-management among almost every major CEFI lender.

Many suspended withdrawals, effectively freezing depositors’ funds as they held the Private Keys, and entered into bankruptcy, with no guarantee funds would ever be returned.

What has been regarded as crypto’s version of the 2008 Financial Crisis plays into the holding meme. You don’t trust centralised services with your Bitcoin, adding another dimension to the hodler’s dilemma.

What about the magical world of DEFI?

CEFI isn’t the only route to passive crypto income, it’s dwarfed in size by its decentralised upstart DEFI, which removes the problem of custody and puts code in charge, administered by Smart Contracts.

But Bitcoin doesn’t natively support Smart Contracts, so the only way to generate DEFI-based passive income is by utilising technical bridges to move your Bitcoin from one blockchain to another, where it becomes a synthetic version that fits with the DEFI money lego for that chain. Are you still following along?

The problem is that those bridges are very insecure, with over $2bn lost in hacks in 2022 alone. Even if you can jump from Bitcoin to another chain that supports DEFI (most likely Ethereum), the Smart Contracts that act as bank bots are subject to exploitation because the code they execute is only as reliable as the human that wrote it.

All of that risk runs counter to the hodling mentality. You don’t endure the pain of a Bear Market to gleefully hand over your Bitcoin to a glorified banking bot; how do you explain that to the future generations who might have inherited those precious digital coins?

Summarising the hodler’s dilemma

Let’s take a step back and summarise what we’ve learned about hodling, the paradox it presents and see an aspect of the argument we might have missed:

- Hodlers won’t sell or spend Bitcoin because their belief in its digital scarcity and network effects make a rational argument for it being worth more in the future

- Hodlers feel abandoned by the financial system & Bitcoin is a life raft they don’t want to let go of

- Hodlers attachment to their Bitcoin is entrenched through punishing Bear Markets and euphoric Bull Markets, with the Endowment Effect and assorted behavioural quirks only amplifying that bond

- Hodlers won’t trade Bitcoin because of the difficulty in timing short-term fluctuation & instead favouring low-time preference thinking

- Holders won’t generate passive income from CEFI because it means relinquishing control which is antithetical to self-sovereign money

- Holders won’t generate income from DEFI because it is complex and risky, requiring trust in bridges to wrap Bitcoin, many of which are centralised

So does the hodler’s dilemma mean that ownership only makes sense in terms of itself, bordering on a religious act of faith with no tangible utility? No, it is simply a great illustration of the universal truth that there’s no such thing as a free lunch.

Unless you’re willing to run the risk of taking a vintage Ferrari on the road, it will just sit under a dust sheet in your garage. Likewise, to enjoy an expensive painting, you’ll need to have it on prominent display with all the associated risks of damage or theft as a trade-off for your utility.

Unlike a piece of art or vintage car, unless it’s being spent or generating an income, Bitcoin doesn’t provide any personal utility; it’s just a 256-bit binary number sitting on a digital ledger.

Hodling is a positive sum game

If you want to leverage the digital value stored within Bitcoin’s shared ledger, you’ll have to take some risk; otherwise, doesn’t hodling forever become a futile exercise? That depends on what value you put on the future and the part that Bitcoin might play in improving it.

Hodling’s end game is for Bitcoin to replace fiat money as the dominant financial system, fixing many of the issues that money with no restrictions controlled by a privileged few has created.

This isn’t to suggest that holders are primarily driven by altruism. The genius of Bitcoin’s design is that it functions through economic incentive – greed can be good – but the outcome is a net positive for all users.

Bitcoin has effectively nudged the cohort of users who genuinely believe in its function and benefits into a positive sum game.

The clever part is that this works because individuals are focused on their own economic benefit, not in spite of it.

No Free Lunch

There is no such thing as a free lunch, but if you’re hungry to find out why, we’re here to help.

You can learn the meaning and origin of the no free lunch concept, as well as the broader philosophy behind the idea that nothing can ever be regarded as free.

We look at our relationship with money and truth, examining all of the supposed shortcuts, life hacks and get-rich-quick schemes.