What are the craziest ever money-making schemes? How about mining asteroids for precious metals, cornering the silver market or towing icebergs to release trapped gold? We’ve pulled together some of the maddest money-making ideas.

Running through our most enduring legends, like King Midas, El Dorado or the Holy Grail, are themes of exploration, discovery and the quest for unimaginable wealth. No surprise, then, that real life seeks to emulate those tales, sometimes in barely believable schemes that seek new sources of fortune in unexplored corners of the earth, in space or new digital frontiers. From mining asteroids to towing icebergs, we’ve pulled together the craziest money-making schemes.

Towing icebergs to mine gold

In an age where we’re teaching our kids to be able to fact-check headlines towing icebergs thousands of miles from the Arctic hoping to release gold and cure tropical diseases should send the bullshit-meter into overdrive – it just happens to be true.

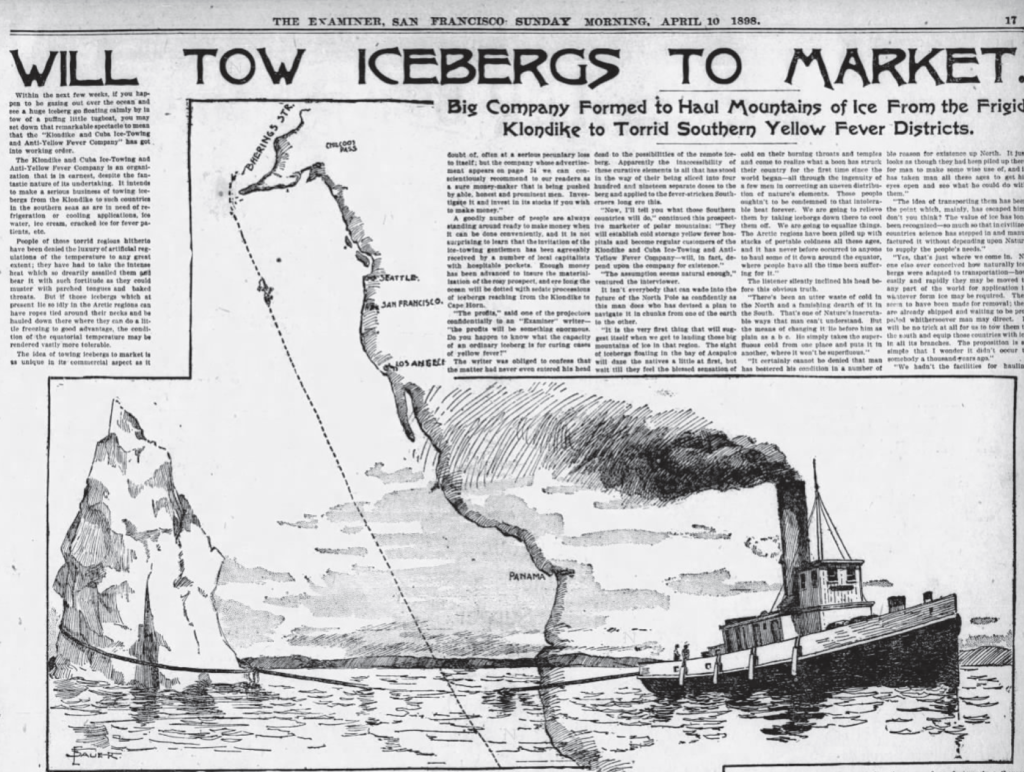

On April 10th 1898, the San Francisco Examiner ran a full-page article on the Klondike and Cuba Ice-Towing and Anti-Yellow Fever Company.

It intends to make a serious business of towing icebergs from the Klondike to such countries in the southern seas as are in need of refrigeration or cooling applications, ice water, ice cream, cracked ice for fever patients

The San Francisco Examiner, April 10th, 1898

Though attempting to tow an iceberg halfway across the Pacific would probably be worth it, for the shits and giggles, it appears that there was some sort of business plan.

Without referencing an investor deck, the San Francisco Examiner, itself quoting ‘The Mining and Industrial Reporter,’ mentioned two viable revenue streams derived from this ocean-based crackpot idea.

Curing Yellow Fever

Without providing much in the way of peer-reviewed science, the Klondike and Cuba Ice-Towing and Anti-Yellow Fever Company expected to quench the parched tongues and baked throats of sufferers from Acapulco to Panama and had at least run some numbers.

“[The yellow fever hospital] will be established as soon as we appear down there with a few icebergs to begin on. They will pay us at the rate of $1,000 per patient. That will aggregate to $419,000 per iceberg.”

The San Francisco Examiner, April 10th, 1898

Releasing vast quantities of gold

The second and much more lucrative-sounding hustle was melting the icebergs to yield vast quantities of gold.

There is little detail as to how this would be accomplished, but it at least answers why the icebergs had to be from the Klondike, the site of the last great gold rush from 1896-99.

Such was the mania that Klondike created it even had a meme, Klondicitis. Iceberg Towing was risk-averse compared to some of the other ideas that emerged from the gold-inspired hysteria.

There were snow bikes, amphibious boat sledges and all manner of balloons. Nikalo Tesla promoted an X-Ray that could detect gold in the ground, while another scheme proposed sucking gold straight out of the river bed with compressed air.

If that wasn’t strange enough, there was a scheme offering dollar shares in the Trans-Alaskan Gopher Company, which intended to use trained gophers to dig tunnels, promising a return of $10 a minute.

Though I’d love to believe someone had trained Gold digging Gophers, the story is most likely apocryphal.

The Klondike inspired crazy money-making schemes by tapping into mankind’s expansionist mojo, but over the intervening century, we’ve mapped the earth and plundered its easily accessible treasures, so with dollar signs in our eyes, we’ve looked to skies where mining planets and asteroids may become the new Klondike.

- If you like this article, here are five of the strangest ever financial scams

Mining Planets & Asteroids

In 1996, scientist John S Lewis’ wrote a book with a title that set the pulse racing of 20th-century stampeders looking skyward for a new gold rush. “Mining the Sky: Untold Riches From The Asteroids, Comets, And Planets.”

The content didn’t disappoint, either. According to Lewis, it would only require a single asteroid, 1km in diameter, to produce

- the entire Earth’s iron/steel/nickel production for a year.

- Earth’s gold and silver production for 100 years.

- Earth’s platinum group production for 1000 years.

Of course, space is teaming with asteroids, comets and planets, all of which offer similar mineral potential, so how much progress have we made towards harvesting this celestial bounty? In truth, not a lot, but not for want of investment.

There have been several attempts to commercialise space mining over the last quarter-century but so far, the amount of space rock returned to earth could probably fill a bucket and would only have symbolic value.

Though SpaceX, Virgin Galactic, and Blue Origins are making serious inroads into space tourism, and we’ve landed on and nudged the orbits of comets, mining planets and asteroids require another level of complexity. Various ideas have been considered:

- Towing asteroids into near-earth orbit

- Nudging their path

- Extracting and processing in space, including producing propellants

- Process on-site, then bring the valuable stuff back

According to Space.com, who sound like they should know what they’re talking about, TransAstra, a California-based mining company, has worked out the wrinkles and is focused on option three, extracting and processing out in space.

Several breakthroughs need to take place technically to enable asteroid mining. We feel we’ve put all those to bed

Joel Sercel, TransAstra CEO.

To be fair, TransAstra has set their sets a little lower than John S Lewis. Rather than kilometre-wide asteroids, they’re focused on using cheap, commercially available telescopes to harvest rocks from 15-50ft, and the focus is on supporting space exploration rather than creating a galactic-gold rush.

TransAstra intends to employ a new tech called Optical Mining. The process uses ‘concentrated sunlight to excavate and extract propellant from volatile-rich asteroids, moons, and planetary surfaces’, which should help cover the cost of making the ride home.

This might sound much less exciting than towing giant space nuggets to Earth, but even if that were technically plausible, it might be a self-defeating exercise as the price of gold would plummet from an endless new supply.

- If you’re interested in more grounded ways to discover wealth, read about the rising interest in metal detecting

Buy up every ticket in a national lottery

In terms of shortcuts to a life of luxury, winning the lottery is one of the most obvious you just have to defeat odds of 45 million to one. But what if you bought a ticket for every possible combination of numbers?

Unfortunately, lotteries are designed to skim some profit for the organisers, so even if you could undertake the herculean task of buying 45 million tickets, you’d even up losing money unless your Stefan Mandel.

Born in Communist Romania in 1934 Mandel used his aptitude for maths, understanding of lotteries and Oceans Eleven level logistical skills to win 12 lottery Jackpots across multiple countries without cheating.

So what was Mandel’s hustle? He simply understood the Achilles Heel of national lotteries – Jackpot rollovers. Under normal circumstances, lotteries offer negative expected value – in other words, for every £2 spent on the UK National Lottery, you should expect to lose. It’s effectively an indirect tax wrapped up in a nice dream.

But, when lottery jackpots are unclaimed they roll over to the next draw and can get big enough to turn the expected value positive.

Mandel scoured lotteries worldwide that were designed such that he could legally pre-fill all the potential ticket combinations, then, like a disciplined hunter, waited patiently for a Jackpot to come along, at which point his well-oiled machine would spring into action.

Mandel taunted Australian lottery officials throughout the 1980s to the extent that they had to change their lottery rules. Not being deterred, Mandel turned his attention to the USA and the Virginia State lottery, offering the perfect set-up for a monumental heist.

- Entries were selected from 1-44 so the maximum number of combinations was only 7.1 million

- Virginia allowed entries to be printed at home

The stars aligned in February 1992 when the Jackpot grew to $27million, representing a potential x3 return on the maximum outlay

Rather than having all the bases covered, Mandel and his team had a 22% chance of missing out on the Jackpot, so were now waiting nervously for the result.

They needn’t have worried as on February 14th, 1992, Mandel’s syndicate picked up the Jackpot and around $900,000 in consolation prizes, taking the overall haul to close to $30 million.

- Read the full story of how Stefan Mandel took on the lotteries and won

Cornering the silver market

After a prolonged period of low inflation, much of the world is grappling with a cost-of-living crisis, but for anyone living through the 70s, this is nothing new.

Inflation in the US hit double figures in 1974, prompting the billionaire Hunt brothers, who made their wealth from Texas oil, to hatch an insane plan to shelter their vast family wealth from inflation and the tax man by investing in a more reliable store of value – silver.

With the help of a Saudi Prince and Swiss bankers, the Hunts began a monumental silver-buying spree, which according to Time magazine, eventually gave them control of almost two-thirds of the world’s privately held supply.

But the plan spiralled out of control as silver prices rose from $11 an ounce in September 1979 to nearly $50 an ounce in January 1980, while a rule change to silver speculation – the purchase of commodities on margin – caught the Hunt’s off-guard threatening to pop their silver-coated bubble and take the entire financial market down with it.

- If you like this story, find out what coin clipping is and how it was a common method for stealing silver and gold

The Hunts had financed their entire ruse on credit, putting down a fraction of the cost of trades as collateral, but by March 1980, they faced having to sell their silver holdings to satisfy new commodities trading rules.

They had become such whales that selling would tank the silver markets, put their existing silver stash in the red and potentially bankrupt the brokers who bankrolled the scheme. Not forgetting the losses to Mainstreet and damage to silver miners.

In a bizarre twist on the too-big-to-fail rescue of banks in the 2008 financial crisis, the Hunts silver heist became so big that the potential was catastrophic without a soft landing for their scheme.

Federal Reserve Board chairman Paul Volcker reluctantly approved an $ 800 million credit line from private banks; the Hunts’ scam had become too big to fail.

On what is known as Silver Thursday (March 27th, 1980), silver collapsed over 30% from $15.80 to $10.80 – and people complain that Bitcoin is volatile.

Such was the ruckus generated that a Senate hearing was called where William Herbert Hunt testified that he bought silver because of rampant inflation and a lack of confidence in the US dollar. “At no time did I attempt to corner, squeeze or manipulate the silver market”.

Whatever their intention, the scheme went from one the craziest money-making schemes to one of the dumbest, causing billions of dollars of losses for those that aped into the scheme.

Here’s a blow-by-blow of the Hunts’ attempt to corner the silver market:

- Starting in 1972, Bunker and Herbert started buying silver – both futures contracts and spot – using margin that on COMEX (the New York Commodities Exchange) required just 4% for a standard contract of 5,000 ounces of silver

- Over time the Hunts gradually increased their holdings, always buying and rarely selling. Around 1975, they looked to build a syndicate of other wealthy investors from the Middle East and Brazil.

- As a dress rehearsal for their plans for silver, the Hunts took a huge position in the Soybean market in 1977, attracting the attention of the Commodities & Futures Trading Commission (CFTC). They were forced to unwind their holdings but learned the limits of the CFTC ability to define market manipulation.

- By 1979 the Hunts had set up a web of companies in the Bahamas, Bermuda and Switzerland to give cover for the purchasing of silver on behalf of a group that now included Lebanese businessmen and a Saudi Prince.

- Silver prices doubled in 1979 as FOMO set in, enabling the Hunts to pyramid, reinvesting their profits to build an even greater position.

- They also employed a tactic that sounds more like a wrestling move than an investing trick, the ‘silver straddle’ buying future contracts as well as short positions allowing them to wash trade to defer or reduce their tax bill.

- In order to squeeze the silver market they preferred to take physical possession of the silver, but wouldn’t bring it to Texas because of a 5% state tax, so they flew much of it to Switzerland

- Read the full story of how the Hunt brothers tried to corner the silver market

No Free Lunch

There is no such thing as a free lunch, but if you’re hungry to find out why, we’re here to help.

You can learn the meaning and origin of the no free lunch concept, as well as the broader philosophy behind the idea that nothing can ever be regarded as free.

We look at our relationship with money and truth, examining all of the supposed shortcuts, life hacks and get-rich-quick schemes.